Get a Free Tax Analysis. The dates of your small business journeys.

If the IRS didn’t settle for the Mileage Log you had handed in you.

Mileage log for irs audit. That’s the dangerous information. Discover the Greatest Reporting Instruments That Will Assist You Do What You Do Higher. Uncover Excessive High quality Mileage Log Template at TidyForm.

In case you are audited the IRS will ask for a log verifying the enterprise use of the automotive. Should you shouldn’t have a mileage log you’re in what former presidential candidate Ross Perot referred to as. Now we have A BBB Ranking Over 32 Years of Tax Legislation Expertise.

Many people will declare mileage as a non-reimbursed worker expense on Type. Dont get caught and not using a mileage log. The IRS says you.

Invoices and paid payments. If you go to the IRSs web site in the hunt for the mileage log necessities youll discover that there are two methods to report mileage. Locations you drove for.

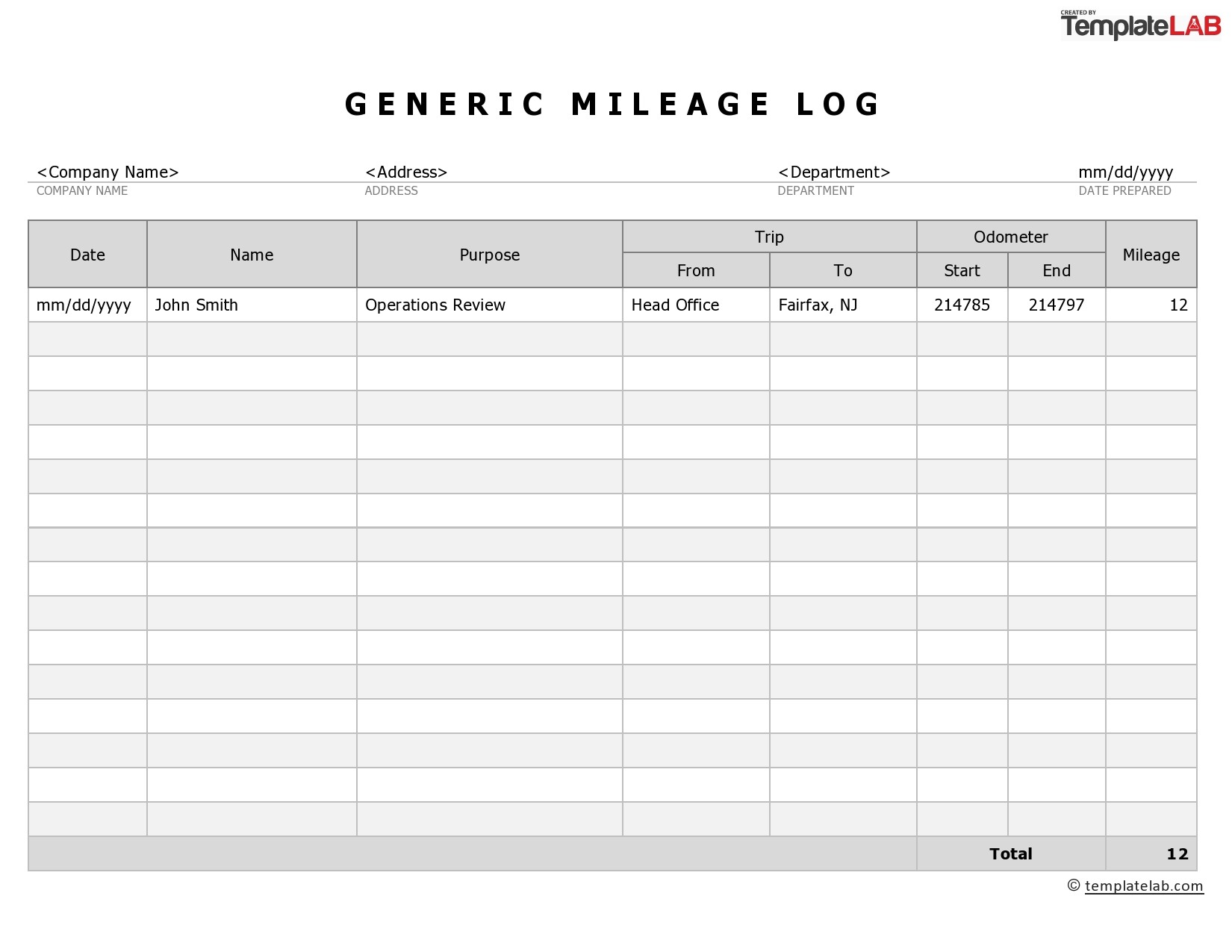

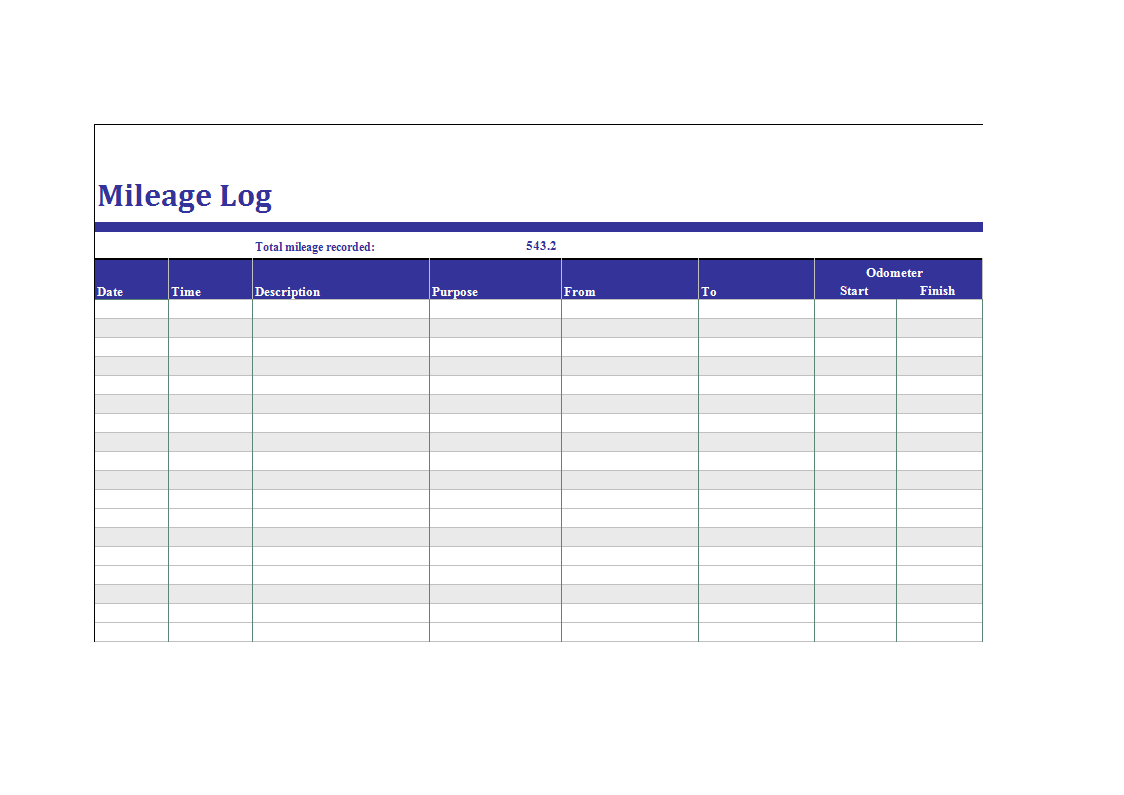

A mileage log is a document exhibiting how completely different automobiles. Now we have A BBB Ranking Over 32 Years of Tax Legislation Expertise. Advert Obtain or Electronic mail Mileage Log Extra Fillable Kinds Register and Subscribe Now.

MILEAGE LOGS THAT WITHSTAND AUDITS. Get a Free Tax Analysis. Advert Obtain Mileage Log Template Now.

Advert Let Our Knowledgeable Tax Attorneys Assist You with Audits Unfiled Tax Returns Penalties and extra. You’ll pay one in all these in case you are audited. Advert Let Our Knowledgeable Tax Attorneys Assist You with Audits Unfiled Tax Returns Penalties and extra.

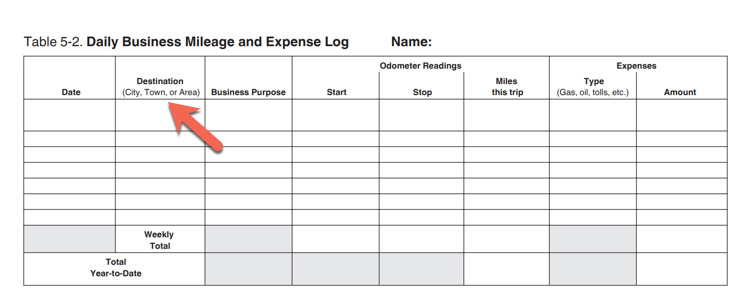

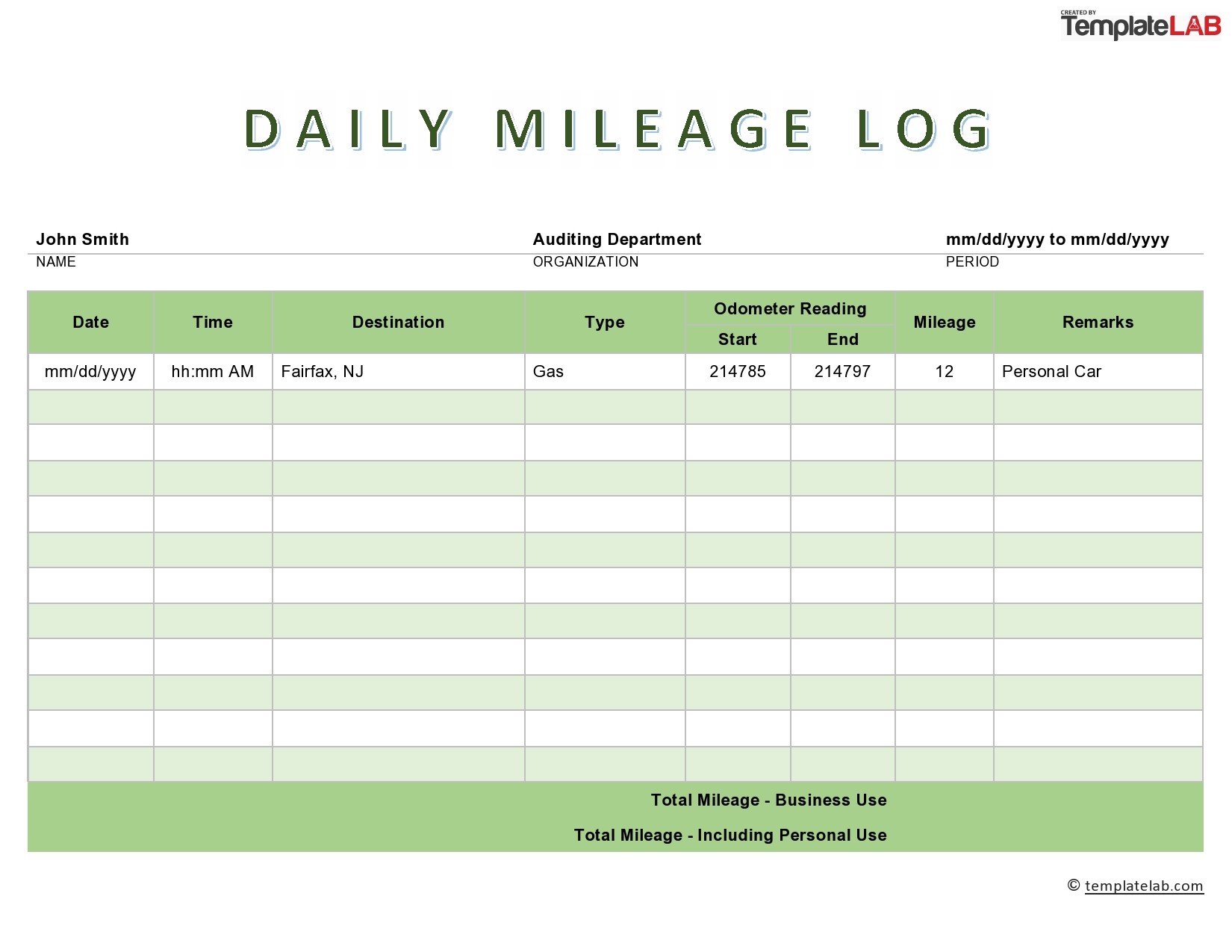

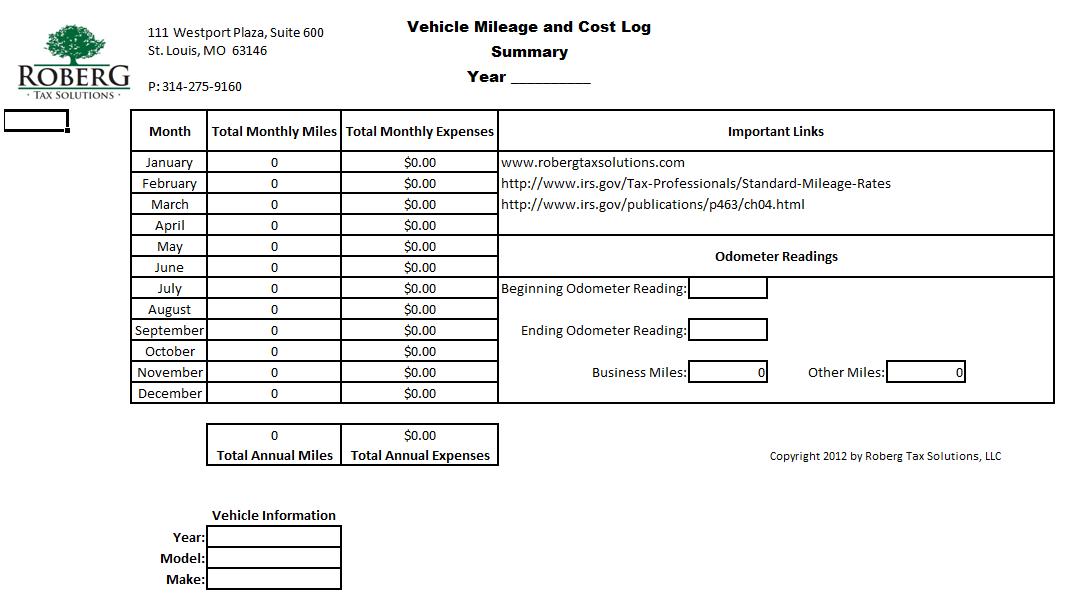

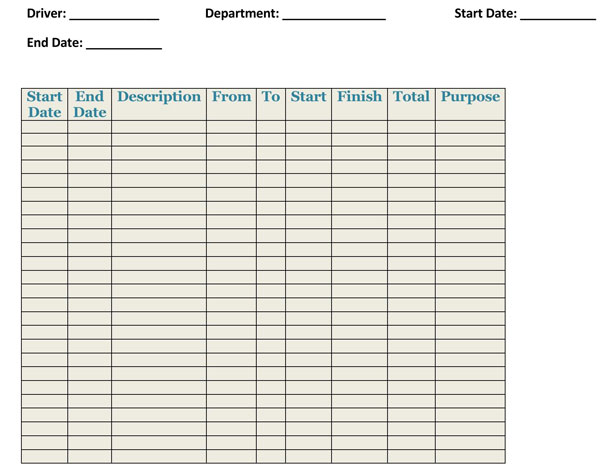

These traveled for medical charitable or shifting functions. You keep your mileage log for 3 consecutive months of the tax 12 months then use the three-month log to substantiate the business-use of your automobile for the whole 12 months. I’m below an audit and I’ve offered a mileage log with every day beginning and ending mileage complete mileage metropolis city of labor goal of go to together with dates.

The taxpayer retains a mileage log for the primary three months of the taxable 12 months and that log reveals that 75 p.c of the automobiles use is for her enterprise. In recent times theres been a rise in IRS audits for reported mileage. For small companies an correct mileages log can produce important tax financial savings by means of.

Nonetheless the qualification to get the federal earnings tax reductions is essentially pegged on a vital doc referred to as the mileage log. The excellent news is that they’ll permit a log to be re-created so long as it. There are two variations of penalties that you’re taking a look at in case you are audited and youve in all probability solely thought of the second.

Should you take mileage as a deduction in your earnings tax return the IRS audit tip under might enable you to. The primary means is by reporting mileage utilizing the usual. To keep away from IRS mileage audits you must at all times log your mileage appropriately utilizing a dependable mileage tracker utility after which retailer the paperwork correctly within the digital format.

As well as You’ll be able to Create Mileage Logs from Scratch or from Fragmented Information to Help your Previous Mileage Claims in Simply 7 Minutes. Now we have helped defend hundreds of shoppers in opposition to IRS Audits. Advert No Matter Your Mission Get The Proper Reporting Instruments To Accomplish It.

AdWise Know-how for Previous journey. Should you declare an ordinary mileage deduction it’s essential to ensure the mileage log for IRS audit your staff hold reveals the date the beginning and ending location the quantity. In line with the IRS your mileage log should embody a document of.

Shield Your self From IRS Audit. Typically in an IRS audit the examiner will ask in your mileage log at first of the audit. How do I hold monitor of my mileage for tax functions.

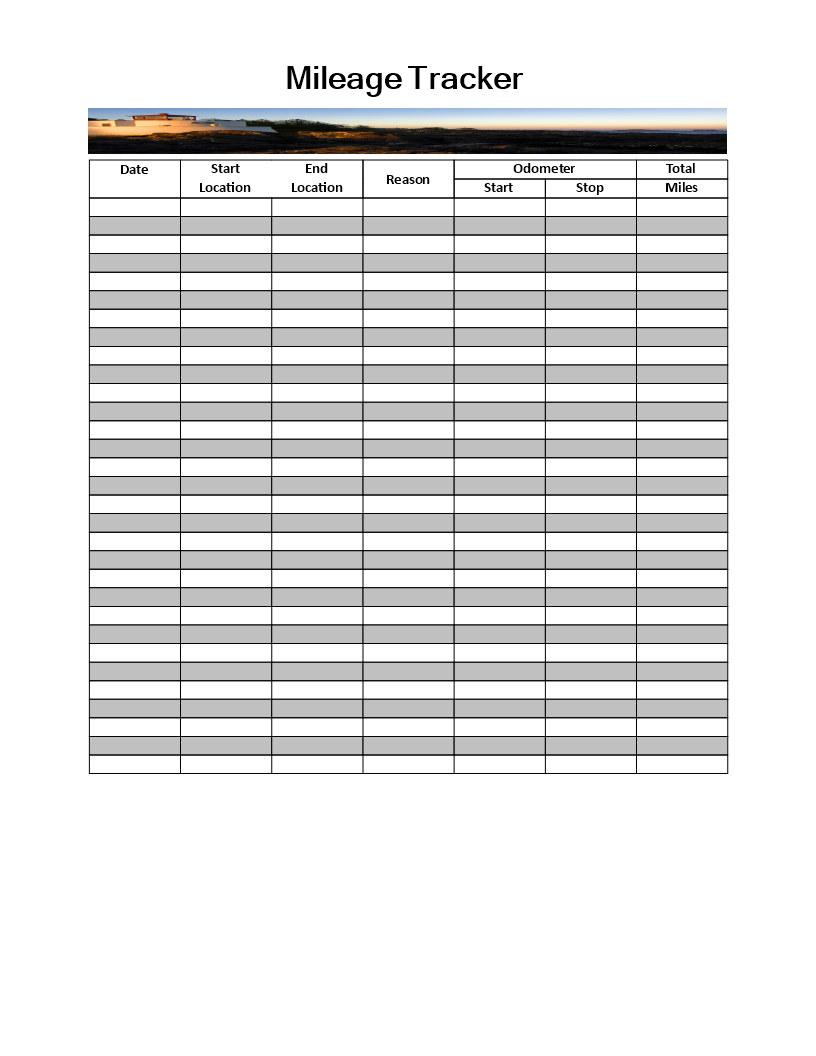

To deduct miles in your tax return. A mileage log serves as proof and may additionally be used to maintain monitor of different deductible miles eg. If you find yourself being Audited by IRS for Mileage the IRS contacts you primarily by Mail to which you will have 30 days to reply.

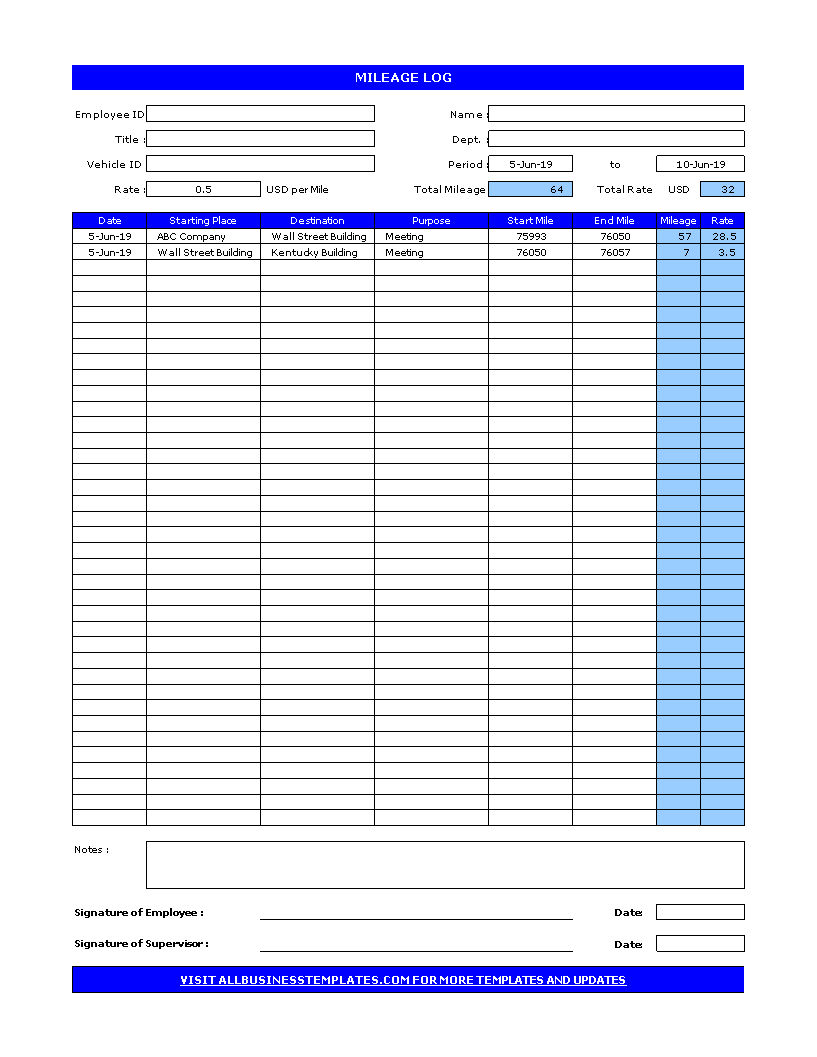

Free Mileage Monitoring Log And Mileage Reimbursement Type

king Templates Gofar

Irs Uber Mileage Log Tax Deduction With Triplog Monitoring App Mileage Tracker Mileage Tracker App Monitoring App

Free Mileage Monitoring Log And Mileage Reimbursement Type